9 genuinely practical tips for building the ultimate watch collection

Benn Dunn, founder of pre-owned specialists Watch Brothers London, tells Esquire the ticks of the trade

THERE ARE SOME BROAD tips you can give anyone wanting to start a watch collection.

Define your “why” – are you collecting for style, investment, mechanical appreciation, or some mix of all three?

Decide on your budget early on, and do as much research as you can.

It’s also helpful to get to know someone on the other side, a person who’s bread and butter is buying and selling watches, ideally one of the good guys who has an interest in doing right by his clientele and building long-term trust.

On that last point, you could certainly do worse than speak to Ben Dunn.

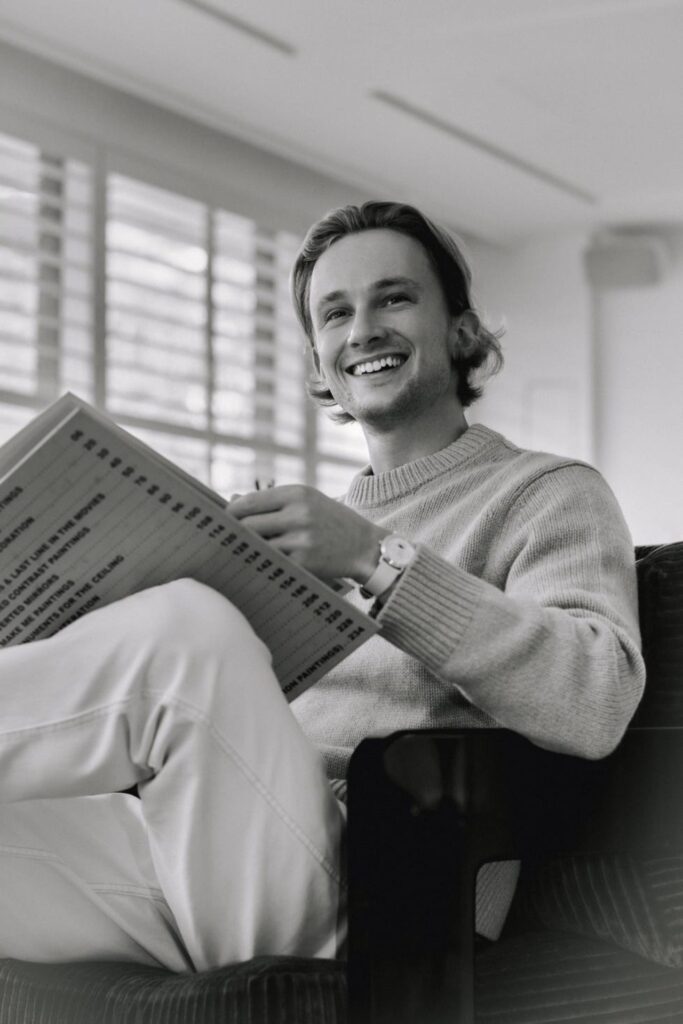

Meet the watch collecting expert

Ben Dunn is the founder of Watch Brothers London (WBLDN), the UK-based pre-owned dealer known for its sharply curated lineup of neo-vintage watches – primarily models from the 1980s to early 2000s that fly under the radar of mainstream dealers.

Dunn’s watch journey began with a broader passion for design and craftsmanship. That curiosity led him to write deep-dive guides on cult classics like the Royal Oak ref. 14790 and Patek Philippe’s 3940 perpetual calendar.

Research turned into a business, fuelled by Dunn’s eye and a few smart connections.

WBLDN began to carve out a niche as the go-to destination for rare, complicated and highly collectible pre-owned pieces.

This summer marks three years since Dunn went all-in on the business – and the results speak for themselves. The current inventory includes heirloom-worthy highlights like a circa 1991 Breguet Classique tourbillon ref. 3350, a 1990 Vacheron Constantin perpetual calendar ref. 43531, and a ‘90s Chopard Luna D’Oro ref. 1206.

Right now, the neo-vintage market is buzzing – driven by nostalgia, relative affordability, and the reach of social media.

For Esquire, Dunn talked us through how to collect watches, from his perspective.

1. Understand that investments can go up or down

Are investment-driven purchases a common ask from clients?

Yeah, that comes up a lot. But it’s more that people don’t want to lose their shirt. Because a lot of them have done before. You can’t blame them. Nobody wants to sign up to a loss, regardless of how much they love the watch.

How do you navigate that?

I think it’s important to let people know how a price really feels in the market – like, does the price feel too expensive? A lot of the modern stuff that people got stuck with – nobody will buy it off them. You can’t consign those watches, because no dealers will want to sign up to that kind of risk. So, it’s just making sure everybody’s aware of what they’re signing up to when they’re buying a watch.

Is the market for the more unusual, dressier pieces growing?

For sure. I wouldn’t say it’s a huge growth area, but my view is extremely skewed because my whole world is this area. Most people who know of watches have got zero clue or interest about the stuff I sell. [Laughs].

But my little sphere is growing, for sure.

2. Make friends with a dealer

Do you help clients shape their collections?

I do help really good clients manage their collections. Everyone has slightly different interests and goals for their collection, and also different budgets.

So, depending on who it is, we’re just trying to move into pieces that feel relevant, both for them and the market.

That concept is always moving, as well. It’s funny when people say, “Collectors – they only collect, they don’t sell.” It’s not true at all. People are always evolving their knowledge or their taste. Sometimes they’ll want gold, or maybe they’ll want to move into a white gold/platinum look now.

And what advice do you give?

It’s just trying to help them understand what they want and then pairing it with something in the market that makes sense, both taste-wise and long-term-wise. It’s about not tying them up in something they can’t then change out of.

3. Try before you buy

What’s a brand that surprises people, but ends up winning them over?

That happens a huge amount with Breguet at the moment. But there’s zero interest pop-culture-wise [in that brand]. You don’t really see those watches anywhere – you’re not exposed to them.

The only way you do see them is if someone shows you them. I see it all the time – when someone sees [a Breguet] for first time and they’re like, “Oh . . . it’s actually kind of cool!” And then they go down the whole rabbit hole.

It’s a market that’s extremely organic. That’s a brand – and a period of production – that is really a surprise to people when they get hands-on.

Are first-time buyers looking for a “real” watch part of your client base?

I think my stuff’s just a bit weird for a first watch. People do come to me from a recommendation [from other people], though. So, they’ll say, “Oh, my friend bought a perpetual [from you]. I’ve never had a 1980s watch, can we do something?” I get a lot of “first time in the genre” people.

4. Know your budget

What about budgets? Do WBLDN customers differ above and below, say, £10k (AUD$21k)?

A lot of people are happy to play – I say “play” in the loose sense –around the 10k or less. That’s where you see this playing out with Cartier, and jewellery-based watches. People are happy to dabble and experiment up to around 10, and then the market just drops off a cliff.

Because over 10 is a hell of a lot of money – and that’s when people start to think, “Will I be able to get that money back if I want to change [ie: free up the money to buy something else]?”

The bigger pieces – 20k, 30k plus – people have already done the work. They’ve read the articles, and they’re ready to take a big step. That’s a very different market.

How do people typically approach building their collections?

That definitely depends. What I see a lot is people trying to trade up and slim down. Someone will say “I’d love to get an 1980s or 1990s perpetual,” and they’ll get – let’s call it an “entry-level” one – a yellow case/ white dial AP or Vacheron in the £15k-£20k (AUD$31k-$42) mark. And then they’ll either fall in love with the style and come back and say, “Look, I need the big daddy. I need the skeleton [ie: the pricier, skeletonised version]”. Or they’ll go, “You know, it’s not really for me.” It goes in one of two directions.

It’s wild they get encouraged to spend more.

Rarely do people collect a number of different watches at the same kind of level. They’ll get one or two, and then they’ll just keep levelling those up.

5. It doesn’t have to be Rolex

How does Rolex sell for you?

Every time I buy a Rolex, I lose money. I am a terrible person to buy Rolex. I think the only ones that have ever worked well for me are the King Midas – and that was until Rihanna blew the roof off the pricing [the singer wore an 18k gold customised King Midas in her 2022 “pregnancy reveal” photo with partner A$AP Rocky].

Now it’s just not something I can buy or sell, because the price signal – the buy cost – is not where I see the value.

Why not?

If I’m totally honest, it’s not a brand that I know enough about to be selling. You really have to have a niche to do well, I think. And it’s obvious to me that when I step outside of that, it doesn’t work. I’ve tried a couple of times, because I do have an interest in some of the models.

My first ever watch was a “Zenith” Daytona [ref. 16520, introduced in 1988, and the first Rolex chronograph to feature an automatic movement, one based on Zenith’s El Primero calibre 400], so Daytonas are very interesting to me. But when someone thinks of a vintage Daytona buyer, they don’t think of Watch Brothers London.

And rightly so, because I don’t have that depth of knowledge. I don’t think it’s a bad thing to admit that you have your areas.

6. Condition is important

How big a deal is condition?

It’s right up there. Most of my buyers aren’t in a rush. They want to get the top, top pieces in terms of condition. Because, you know – why not? You can wait a little bit longer and find something that really grips you for all the right reasons.

You don’t want to have little niggling doubts. You know, when you look down and you’re not quite happy – it’s, like, what’s the point?

7. Consider complications

What kinds of watches should people be looking out for right now?

I think perpetuals are strong, for sure. You look like you’ve got something very complicated. But in theory, if the watch is set, it’s set. You don’t have to worry about it. Also, the history behind the perpetual calendar is brilliant.

A lot of people are interested in tourbillons as well. That space is booming for me, particularly. You can get some really cool, visually appealing watches with a tourbillon at prices that match a modern Daytona.

Breguet aside, is there a brand you think is underrated?

There’s a few emerging ones. Brands like Corum or Ebel. Blancpain as well. But those are just ones where I find the history interesting. But whether the market finds it interesting as well? That’s TBC.

8. Buy what you like

As you’ve said, the downside of “buy what you like” is that what you like might depreciate – and no one wants that.

Yes. People often hear “buy what you like” and then kind of freak out, thinking, “I need to buy what I like but make sure I don’t lose money.” So that’s important as well. I advise getting hands-on with everything you can, to really understand what you do like. I think you’d be surprised. I see people picking out bits I’ve never heard of – and then I look at them and I’m, like, “That’s actually sick. I’d love something like that.” And then I’ll go hunting for it.

For example?

It happened recently with an Oscar Waldan El Primero-based calendar chronograph. I’ve got one now. It’s Tiffany co-signed [ie: it has both the watch brand name and that of its retailer, Tifanny & Co, on the dial, increasing value and rarity]. It’s just a gorgeous, vintage-looking piece. And it cost the price of a Submariner. Absolutely amazing.

9. Don’t worry too much about what “suits” you

One key to collecting is trying watches before you buy – but that’s often easier said than done.

Actually handling the watches and living with them for a bit is really important. Because some things just don’t work for certain people. Which is totally fair enough.

I’ve been wearing a classic Speedmaster lately. It’s too big, but I still love it.

That’s like when I wear these modern Daytonas, my friends are just like, “That looks so wrong on you”. Which hurts me so deeply inside – because I love it, right?

But you have to kind of go through the process.

Because if you can put a watch on and get a bit of joy from it, then what more do you really need?

This story originally appeared on Esquire UK.

Related: